Hot Off the Press – 2019 financial results

Hot Off the Press – 2019 financial results

Chief Financial Officer Murray Lapworth talks about Rātā’s annual financial results and some of the work being done in the finance and investment area.

We’ve all read the news – this year in our global markets has been a particularly rocky ride. The outcome of Brexit and its potential consequences, the US-China trade wars and other factors have contributed to a lot of uncertainty and volatility going forward in the investment world.

What does this mean for Rātā Foundation?

The short answer – we are not immune to market fluctuations. The Global Financial Crisis of 2008-2009 taught us a great deal and over the past ten years we have worked hard to ensure we have the right buffers in place in times of downturn. Our ultimate objective is always to preserve our capital base, whilst maintaining our grants levels.

This year, as announced at last night’s Annual Public Meeting, we have maintained our grant level at $20.3 million, and grown our Trust Fund to $597 million and Total Assets to $607 million at end of financial year 31 March 2019. Given the level of uncertainty this is an extremely positive outcome.

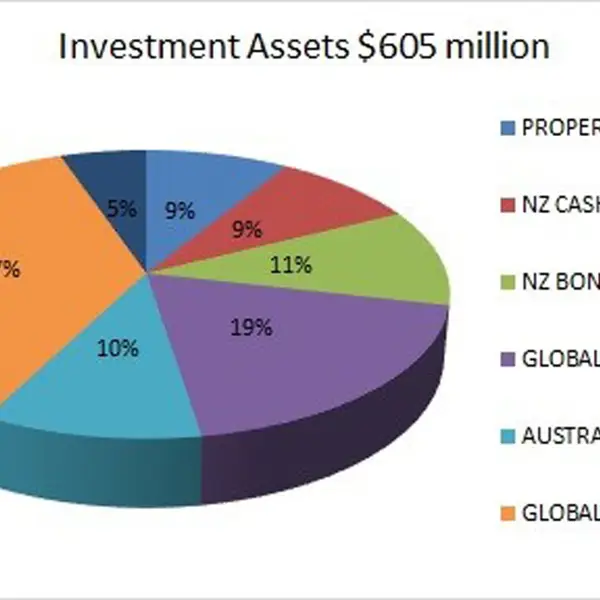

Over the past twelve months we have taken the strategic decision to transition growth assets from 40 percent to 55 percent to seek higher yields in an environment with an outlook for lower returns, to support our community investment grants funding programme.

Another sound decision which has contributed to the bottom-line was to transition our direct property investment, which was inefficient, to quality fund managers with institutional grade property portfolios, producing higher returns.

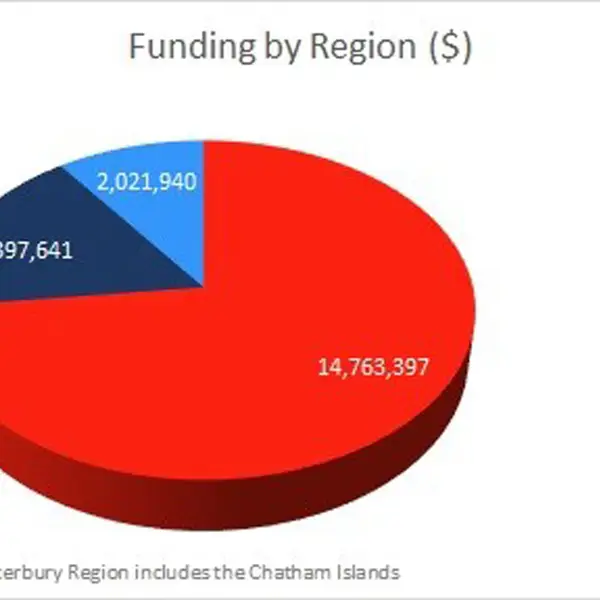

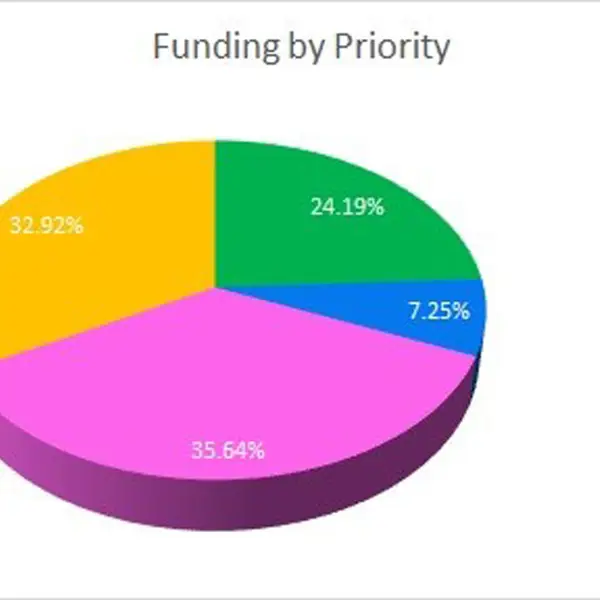

The $20.3 million grants across our funding regions is comprised of - $14.8 million in Canterbury, $3.4 million in Nelson and $2.1 million in Marlborough. Total grants in our funding areas equated to a breakdown of 24 percent to Connect, 8 percent to Learn, 35 percent to Participate and 33 percent to Support.

So, where to from here?

We have established strong relationships with our investment Fund Managers. The strategic changes we have made to our investment strategy ensures that Rātā remains in a sound position, with reserves of 30 months spend providing a buffer to protect our capital base for future generations while still being able to grant money to community organisations during a financial downturn.

We are not immune to market conditions but our community can be confident Rātā is well-positioned to weather any storms.

To view the full set of financial statements please click on this link. Our Grants List for 2018/19 is contained in the Financials.